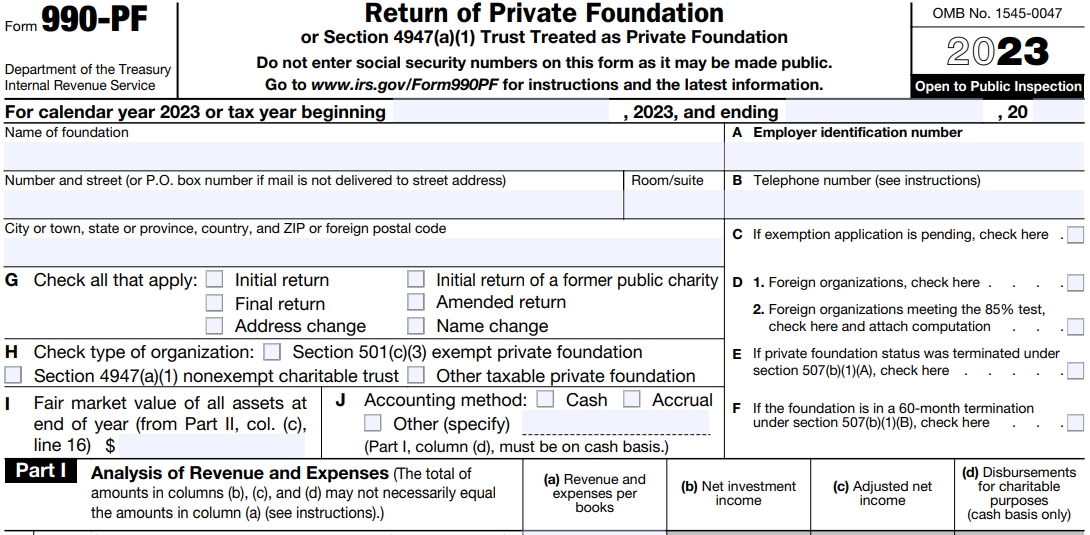

Form 990-PF entitled "Return of Private Foundation" is a report that must be filed each year with the IRS.

It is an information return used to calculate the tax based on investment income and to report charitable distributions and

income-generating activities.

Also, Form 990-PF acts as a substitute for the

Visit https://www.expresstaxexempt.com/form-990-pf/form-990-pf-instructions/ to know more about Form 990-PF Instructions.

Form 990-PF is to be filed by the below different types of foundations listed below:

Private Foundation must file Form 990-PF by the 15th day of the 5th month after the tax year ends. If the organization follows a Calendar Tax year. Find your 990-PF due date.

If the regular due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Form 990-PF can be filed electronically or

by paper.

Filing Form 990-PF electronically

is quick and easy.

It takes less time to process the return, and you instantly get to know the

status of the filing.

The IRS prefers the electronic

filing of Form 990-PF.

Also, e-filing with an IRS-authorized e-file service provider such as Tax 990 is more secure when compared to the paper filing.

The below information are essential to

fill the form:

Eventually, the line 1 to 27, part-I of Form is used to provide the details of your Organizations revenue and expenses.

These 4 columns need to be filled in:

Contributions, gifts, grants, etc., received. Enter the total of gross contributions, gifts, grants, and similar amounts received.

You must complete schedule B if money, securities, or other property valued at $5,000 or more was received directly or indirectly from any one person during the year.

Line 12 is the total revenue received by the organization

during the year.

This gives an idea for the researchers about the size of your foundation's operations.

Enter the compensation of officers, directors, trustees, etc., employee's salaries, pension plans, employee benefits, and other fees such as legal, accounting, and other professional fees, and interest paid.

Line 26 will be the total expenses and disbursements of your organization during the year.

Subtract the total expenses and disbursements with the total revenue to calculate the excess of revenue, Net investment income, and Adjusted net income.

This section discusses information about the organization's assets, liabilities, and net assets.

Deposit in checking accounts, cash in savings investments, money market funds, grants receivable from governmental agencies, all receivables due from officers, directors, trustees, foundation managers, Land, buildings, and equipment

Enter the total of accounts payable to suppliers and others and accrued expenses, such as salaries payable, Unpaid portion of grants and awards, Unpaid balance of loans received from officers, directors, trustees, and other disqualified persons

The information you enter will be used to calculate the foundation's Net Assets or Fund Balances.

Here you enter the list of property sold, Gross sales price, Date acquired, How acquired, Date sold, Capital gain net income, Net short-term capital gain. Non-Operating private foundations may not have to figure their short-term capital gain or loss on line 3 of Form 990-PF.

Used by domestic private foundations (exempt and taxable) to determine whether they qualify for the reduced 1% tax under section 4940(e) on net investment income rather than the 2% tax on net investment income under section 4940(a). You provide details of adjusted qualifying distributions and Net value of noncharitable-use assets.

Here you enter the taxes based on investment income, taxes paid with tax extension Form 8868, backup withholding, total credits and payments.

Generally, for political purposes, that part includes political expenses, unrelated business income, and reimbursement (if any) paid by the foundation during the year for political expenditure tax. Also, provide information on Form 1120-POL if filed this year.

Other activities to be reported:

Private Foundation must provide the list of the names, addresses, and other information requested for those who were officers, directors, and trustees of the foundation at any time during the year.

Also include the following details of the officers:

List all officers, directors, trustees, and foundation managers and their compensation, and the compensation of five highest-paid employees

Five highest-paid independent contractors for professional services

To calculate the minimum investment return, include only those assets that aren't used or held for use by the foundation for a charitable, educational, or other similar function that contributed to the charitable status of the foundation.

Also, enter the Fair market value of assets and securities, monthly cash balances, fair market value of all other assets, and the average monthly cash balances.

Qualifying distributions are amounts spent or set aside for religious, educational, or similar charitable purposes. The total amount of qualifying distributions for any year is used to reduce the distributable amount for specified years. This helps to arrive at the undistributed income (if any) for those years on Part XII of Form 990-PF.

Part XI of Form 990-PF is used for Private non-operating foundations to calculate their minimum investment return to calculate their distributable amount.

Part XIII of Form 990-PF is to enable the private foundation to comply with the rules for applying its qualifying distributions for the year 2019.

On how to report the qualifying distributions, check out the basic steps here.

Here you provide information on the recipients of the funds.

Enter all contributions, grants, and more actually paid during the year, including grants or contributions that aren't qualifying distributions under section 4942(g).

Enter all contributions, grants, etc., approved during the year but not paid by the end of the year, including the unpaid portion of any current-year set-aside.

Visit

https://www.expresstaxexempt.com/form-990-pf/form-990-pf-instructions/

to know more about

Form 990-PF Instructions.

Depending on the state requirements, the organization must send a copy of Form 990-PF and, if applicable, additional schedules, instead of their financial report.

Determine state filing requirements

Discuss with the officials in the state and other jurisdictions in which the organization is doing business to determine their state-specific filing requirements. "Doing business" in a jurisdiction may include any of the following:

If the organization files an amended return with the IRS, a copy of the amended return must also be sent to the State Department.

Many states require that all amounts be reported based on the accrual method of accounting.

The filers must send a copy of Form 990-PF and Form 4720 (if applicable) to the State Attorney General of:

The following forms may be required to report social security, medicare, and income taxes withheld from the employee, and the social security and medicare tax contribution made by the employer.

If the employer does not withhold income tax, social security, and Medicare taxes when it is mandatory to do so or fail to pay the withheld taxes to the IRS, a trust fund recovery penalty may apply. The penalty would be 100% of

the unpaid taxes.

Form990pfinstructions.com provides an easy to use interface to file Form 990 PF electronically. With our step by step filing process, completing and transmitting your Form 990-PF wont be a hassle anymore. Also, our support team is always ready to assist you with any queries that you may have during filing process.

Add Organization Details

Choose Tax Year

Enter Form Data

Review your Form Summary

Transmit it to the IRS